FinCEN Extends Certain Filing Deadlines Under the Corporate Transparency Act

As we previously reported, on December 3, 2024, in Texas Top Cop Shop, Inc. v. Garland, a judge in the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction temporarily preventing the U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) from enforcing the Corporate Transparency Act (“CTA”).

On December 23, 2024, the U.S. Court of Appeals for the Fifth Circuit entered an order staying the preliminary injunction. This means that the preliminary injunction is no longer in effect and FinCEN may enforce the CTA.

After the ruling, FinCEN issued an Alert extending certain deadlines to file beneficial ownership information reports:

- Reporting companies created or registered before January 1, 2024 have until January 13, 2025 to file.

- Reporting companies created or registered on or after September 4, 2024 that had a filing deadline between December 3, 2024 and December 23, 2024 have until January 13, 2025 to file.

- Reporting companies created or registered on or after December 3, 2024 and on or before December 23, 2024 have an additional 21 days from their original filing deadline to file.

- Reporting companies created or registered on or after January 1, 2025 have 30 days to file.

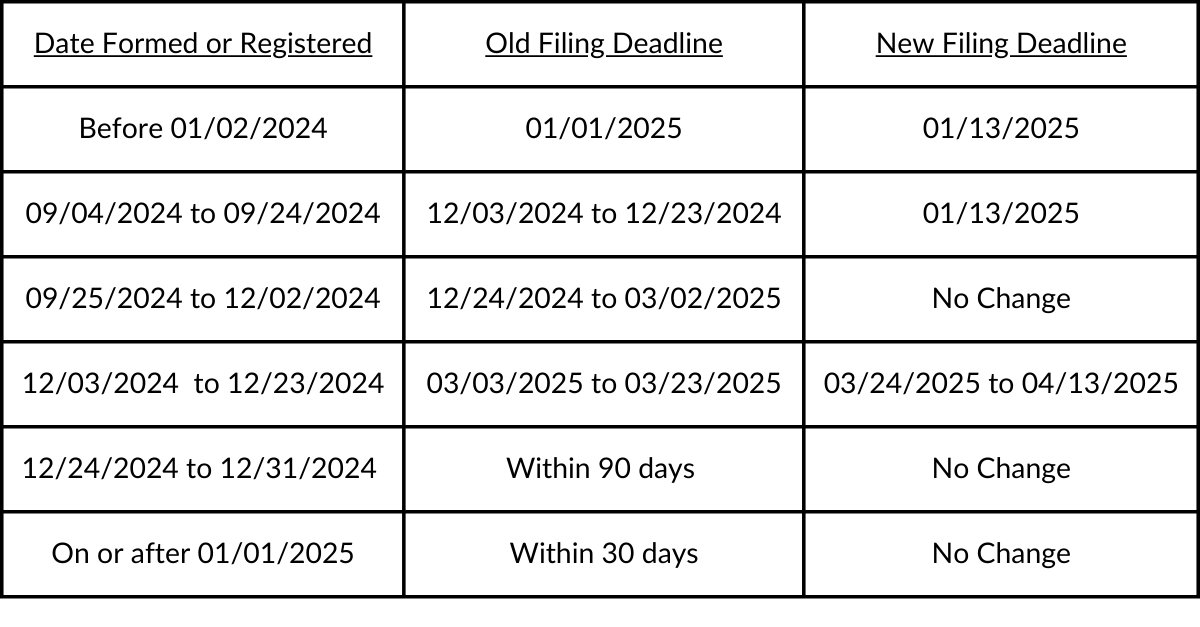

As a result of the extensions, the filing deadlines can be summarized as follows:

For some reason, FinCEN determined that companies created or registered between September 25, 2024 and December 2, 2024 did not require an extension of the filing deadline. Therefore, for example, a company formed on September 25, 2024 must file its report by December 24, 2024!

Please review our November 2024 advisory for more information on the CTA.

If you have any questions, please contact Gianfranco Pietrafesa at gpietrafesa@archerlaw.com or 201-498-8559, or any member of Archer & Greiner’s Business Counseling Group.

DISCLAIMER: This client advisory is for general information purposes only. It is a summary, not a full analysis, of the topic. It is not intended, and should not be construed, as legal advice, and may not be used or relied upon as a substitute for legal advice by a qualified attorney regarding a specific matter. It may be considered an advertisement for certain purposes.