Guest Blog

Written By: David H. Nachman, Esq. Ludka Zimovcak, Esq. Snehal Batra, Esq. Samantha Oberstein, Esq. Nachman, Phulwani, Zimovcak (NPZ) Law Group, P.C. With immigration enforcement expected to intensify under the current administration, U.S. businesses face heightened scrutiny of their hiring and employment practices. One area of particular focus is Form I-9 compliance. The consequences of non-compliance can be steep, including hefty fines and potential workforce disruptions. Here’s how businesses can act now to prepare and protect their operations. Why I-9 Compliance Matters Form I-9 is used to verify the identity and work authorization of every employee in the U.S. While…

Read MoreWritten By: Kenneth A. Rosenberg Kelly McNaughton Fox Rothschild President Donald Trump’s recission of a 1965 Executive Order (EO) raised questions about how the U.S. Department of Labor (DOL) would handle open investigations, pending cases, audits and complaints, as well as whether active conciliation agreements would be enforced. The answer came on Jan. 24, 2025 when Acting Secretary of Labor Vincent N. Micone III directed DOL employees to cease all investigative and enforcement activity under rescinded EO 11246. Those covered by Secretary’s Order 03-2025 include employees of the Office of Federal Contract Compliance Programs (OFCCP), the Office of Administrative Law Judges and the…

Read MoreWritten By: Kenneth A. Rosenberg Partner Fox Rothschild President Donald Trump issued an Executive Order (EO) on Jan. 22, 2025 revoking several previous executive orders, including one that prohibited federal contractors and subcontractors from discriminating in employment based upon race, color, religion, sex, sexual orientation, gender identity or national origin and that required them to take affirmative action to ensure equal opportunity in all aspects of employment One of the orders it revokes, EO 11246, was originally issued by President Lyndon B. Johnson in 1965, establishing the requirement that certain federal contractors and subcontractors establish affirmative action programs. As a result, not only…

Read MoreWritten By: David H. Nachman, Esq. Ludka Zimovcak, Esq. Snehal Batra, Esq. Samantha Oberstein, Esq. Nachman, Phulwani, Zimovcak (NPZ) Law Group, P.C. The U.S. Department of Homeland Security (DHS) recently issued two critical final rules that promise to transform key aspects of the H-1B visa program and Employment Authorization Documents (EADs). These updates, effective mid-January 2025, aim to modernize immigration pathways, enhance program integrity, and provide much-needed flexibility for employers and foreign workers alike. Permanent Extension of EAD Validity Periods Effective January 13, 2025, the DHS will permanently extend the automatic renewal period for EADs from 180 days to 540…

Read MoreWritten By: Mike Simon Principal The DAK Group msimon@dakgroup.com M&A in the middle market has been strong and active in 2024, following a relatively subdued 2023. Since the middle market is primarily made up of privately held companies, the ebb and flow of M&A has always been fairly consistent, unlike M&A in large publicly traded businesses which see large swings in M&A activity. With the Presidential Election behind us and a number of positive economic indicators, we see 2025 as a great time to buy or sell a business. The M&A business cycle is cyclical, driven by many factors, but…

Read MoreWritten By: Gianfranco A. Pietrafesa Partner Archer & Greiner PC On December 3, 2024, in Texas Top Cop Shop, Inc. v. Garland, the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction temporarily preventing the U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) from enforcing the Corporate Transparency Act (“CTA”). See our Advisory. On December 23, 2024, a “motion panel” of the U.S. Court of Appeals for the Fifth Circuit entered an order staying the preliminary injunction, thus allowing FinCEN to enforce the CTA. See our Advisory. Shortly thereafter, FinCEN issued an alert extending certain deadlines to…

Read MoreWritten By: Loopwell A company event shouldn’t feel corporate. When was the last time you heard someone get excited about going to a hotel ballroom meeting? The fact is, corporate culture is built, not born. That’s why Loopwell is reinventing the way companies invest in their people by focusing on their well-being. Research shows that infusing well-being into corporate programming results in more productive, engaged and loyal employees, and more effective leaders. It’s a great way to attract top talent, engage clients and give a little something back – all while boosting the return on your investment. You spend a…

Read MoreWritten By: Gianfranco A. Pietrafesa Partner Archer & Greiner PC As we previously reported, on December 3, 2024, in Texas Top Cop Shop, Inc. v. Garland, a judge in the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction temporarily preventing the U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN“) from enforcing the Corporate Transparency Act (“CTA“). On December 23, 2024, the U.S. Court of Appeals for the Fifth Circuit entered an order staying the preliminary injunction. This means that the preliminary injunction is no longer in effect and FinCEN may enforce the CTA. After the ruling,…

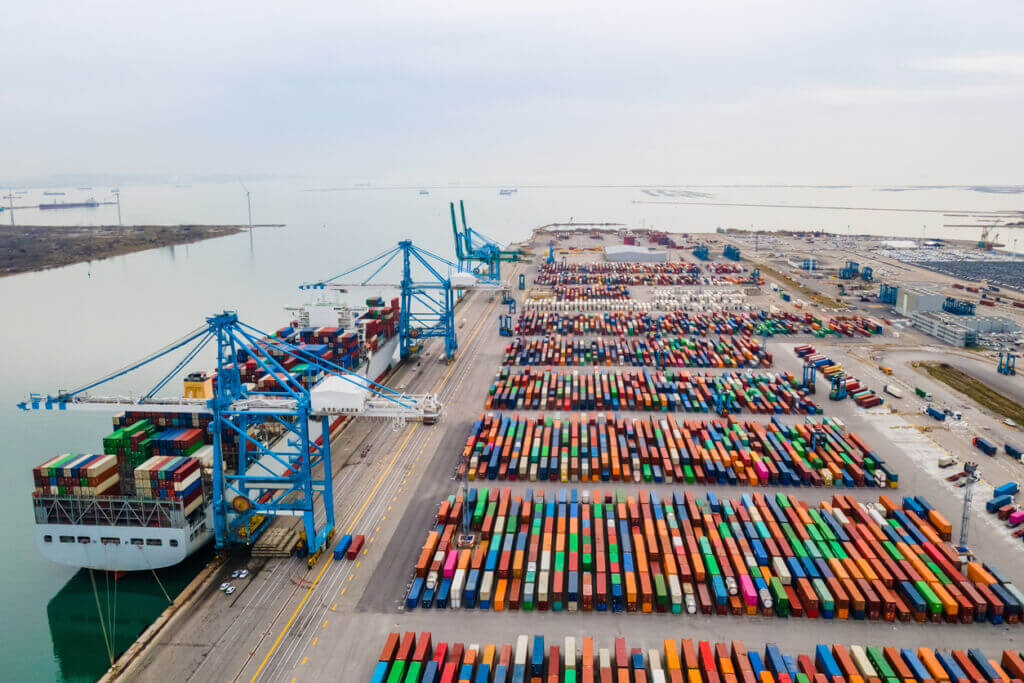

Read MoreWritten By: Paul Harencak, Vice President, Operations, LPS Industries As we approach a new year and a new presidential administration, there are issues lurking about that need close monitoring and attention. Here’s a short list of some of the major issues that I see. Concerns Supply Chain – continued worries about political sanctions and piracy in and around the Red Sea and Suez Canal as well as the tensions between China and Taiwan. Not to mention the Middle East wars. For many sea freight companies this means cargo is wrapping around Africa or finding alternative routes, increasing ship time…

Read MoreWritten By: Gianfranco A. Pietrafesa Archer & Greiner P.C. The Corporate Transparency Act (“CTA“) requires more than 32 million domestic and foreign companies to file a beneficial ownership information report (“BOI Report“) with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN“). A BOI Report discloses certain information about the companies and their “beneficial owners”, which include persons directly or indirectly owning or controlling 25% or more of the ownership interests, senior management, and other persons directly or indirectly substantially controlling a company. Companies in existence before January 1, 2024 must file a BOI Report by January 1, 2025.…

Read MoreEach week, we feature a guest blog from one of our members on an issue that's important to business. Want to write for CIANJ? E-mail arusso@cianj.org to get your organization published here.